Source: shutterstock

Portfolio Management Services (PMS) funds are gaining traction among High-Net-Worth Individuals (HNIs) due to their personalized approach and potential for superior returns. These funds offer tailored solutions that align with the specific financial goals of investors. But what sets PMS funds apart from traditional investment options like mutual funds? Let’s explore this premium investment avenue.

What Are PMS Funds?

Portfolio Management Services, commonly known as PMS, is a specialized investment service where skilled portfolio managers craft and implement strategies that cater to the unique financial goals of individual investors. Unlike mutual funds, PMS provides significant customization and enables investors to maintain a focused portfolio that reflects their specific preferences. In India, SEBI regulations mandate a minimum investment of ₹50 lakh for PMS, making it a tailored solution for affluent investors.

Top Portfolio Management Services (PMS)

The best performance was given by InCred Asset Management’s Incred Focused Healthcare Portfolio, which achieved an impressive 70.6% return. Closely following is Stallion Asset Pvt Ltd's Core Fund, with a strong 70.5% return. Wallfort PMS and Advisory Services LLP’s Diversified Fund also performed well, returning 65.8% in the first year. Investsavvy Portfolio Management LLP’s Alpha Fund achieved 59.0%, demonstrating solid growth. Lastly, Green Lantern Capital LLP’s Growth Fund delivered a return of 54.7%. These PMS options show strong returns in the 1-year period, making them attractive choices for investors seeking short-term growth.

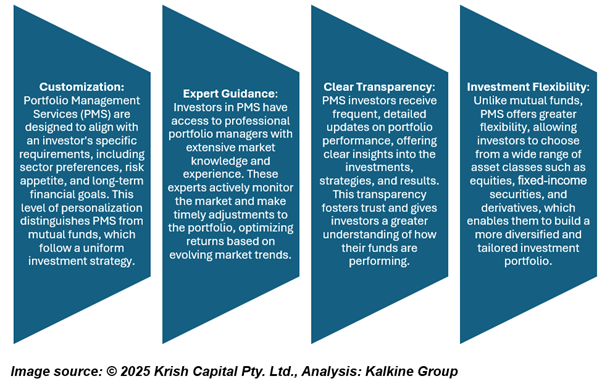

Key Benefits of PMS Funds

There is a wide range of Portfolio Management Services (PMS) funds available for investors to choose from, depending on their financial goals, risk tolerance, and investment preferences. Each PMS fund operates in a specific category and follows its unique strategy. To help investors make informed decisions, let’s discuss some of the key categories of PMS funds and their performance highlights.

1. The top-performing Flexi Cap PMS funds based on 1-year returns are led by Investsavvy Portfolio Management LLP’s Alpha Fund, which delivered a strong return of 59.0%. It is followed by JM Financial Services’ India Resurgent Portfolio Series - 111, with a return of 44.2%, and Asit C Mehta Investment Intermediates Ltd’s ACE-Multicap, which achieved 43.7%. Emkay Investment Managers Ltd’s Golden Decade of Growth posted a return of 39.4%, while JM Financial Services’ Apex rounded out the list with a return of 34.8%. These funds showcase strong performance in the 1-year period, making them notable choices in the Flexi Cap category.

2. The top-performing Large & Mid Cap PMS funds based on 1-year returns are led by Torus Oro Portfolio Management Pvt Ltd’s All Weather Portfolio, which delivered a return of 42.0%. This is followed by SageOne Investment Advisors LLP’s Large and Midcap Portfolio with a return of 40.0%, and Green Lantern Capital LLP’s Alpha Fund, which achieved 40.0%. Alchemy Capital Management’s Smart Alpha 250 posted a return of 37.6%, while Care Portfolio Managers Pvt Ltd’s Large and Midcap Strategy rounded out the list with 36.7%. These funds demonstrate solid performance, making them strong contenders in the Large & Mid Cap category.

3. The top-performing Large Cap PMS funds based on 1-year returns are led by Standard Chartered Securities India Ltd’s Long Term Value Compounder, which achieved a return of 37.4%. This is followed by ICICI Prudential AMC Ltd’s Large Cap Strategy, which delivered 36.7%, and Capitalmind Financial Services’ Market Fund, which posted 32.6%. Narnolia Financial Services Ltd’s Large Cap achieved a return of 31.8%, while Asit C Mehta Investment Intermediates Ltd’s ACE-15 rounded out the list with 31.0%. These funds represent strong performance in the Large Cap category.

4. The top-performing Mid Cap PMS funds based on 1-year returns are led by NAFA Asset Managers Pvt Ltd’s Clean Tech Portfolio, which delivered a return of 47.5%. It is followed by Asit C Mehta Investment Intermediates Ltd’s ACE-Midcap, which posted a return of 45.2%. Nippon Life India Asset Management Ltd’s Emerging India achieved a return of 32.5%, while Nuvama Asset Management Limited’s Equities eXpansion Target posted 32.1%. Right Horizons’ Super Value rounded out the list with a return of 31.2%. These funds demonstrate strong performance in the Mid Cap category.

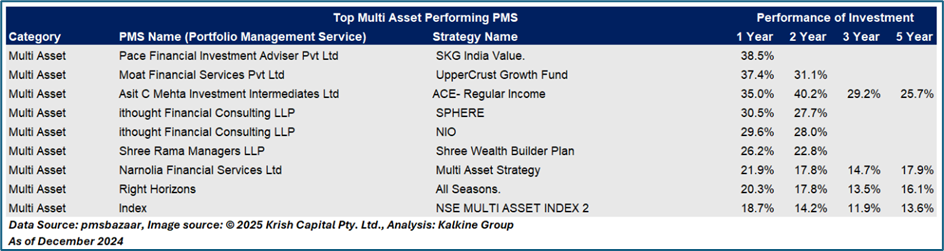

5. The top-performing Multi Asset PMS funds based on 1-year returns are led by Pace Financial Investment Adviser Pvt Ltd’s SKG India Value, which delivered a return of 38.5%. It is followed by Moat Financial Services Pvt Ltd’s UpperCrust Growth Fund, which achieved 37.4%. Asit C Mehta Investment Intermediates Ltd’s ACE-Regular Income posted a return of 35.0%, while ithought Financial Consulting LLP’s SPHERE achieved 30.5%. ithought Financial Consulting LLP’s NIO rounded out the list with a return of 29.6%. These funds showcase strong performance in the Multi Asset category.

6. The top-performing Multi Cap PMS funds based on 1-year returns are led by Stallion Asset Pvt Ltd’s Core Fund, which delivered an impressive 70.5%. It is followed by Quest Investment Advisors’ Multi, which posted a return of 52.7%. Moat Financial Services Pvt Ltd’s UpperCrust Wealth Fund achieved a return of 50.3%, while Ambit Global Private Client’s Alpha Growth achieved 50.0%. Carnelian Asset Management and Advisors Pvt Ltd’s YNG Strategy rounded out the list with a return of 49.9%. These funds showcase strong performance in the Multi Cap category.

7. The top-performing Small & Mid Cap PMS funds based on 1-year returns are led by Wallfort PMS and Advisory Services LLP’s Diversified Fund, which delivered a return of 65.8%. It is followed by Green Lantern Capital LLP’s Growth Fund, which posted a return of 54.7%. SVAN Investment Managers LLP’s Velocity achieved a return of 52.0%, while Badjate Stock Shares Pvt Ltd’s Aggressive posted 48.6%. Wallfort PMS and Advisory Services LLP’s Ameya Fund rounded out the list with a return of 48.1%. These funds highlight strong performance in the Small & Mid Cap category.

8. The top-performing Small Cap PMS funds based on 1-year returns are led by Equitree Capital Advisors Pvt Ltd’s Emerging Opportunities, which delivered a return of 52.2%. It is followed by Accuracap’s Dynamo, with a return of 45.6%. Counter Cyclical Investments Pvt Ltd’s Diversified Long Term Value posted a return of 43.5%, while Right Horizons’ Super Value Aggressive achieved 40.9%. Centrum PMS’s Micro rounded out the list with a return of 37.0%. These funds stand out in the Small Cap category for their strong performance.

9. The top-performing Thematic PMS funds based on 1-year returns are led by InCred Asset Management’s Incred Focused Healthcare Portfolio, which delivered an impressive return of 70.6%. Following closely is Green Portfolio Pvt Ltd’s The Impact ESG Fund, which posted a return of 55.8%. InCred Asset Management’s Healthcare Portfolio achieved a return of 55.2%, while Valcreate Investment Managers LLP’s IME Digital Disruption posted 54.7%. Green Portfolio Pvt Ltd’s Super 30 Dynamic rounded out the list with a return of 45.5%. These funds shine in the Thematic category with strong performance.

Costs Associated with PMS Funds

Top 5 PMS Funds to Invest in 2025 for High Returns and Long-Term Growth

Here are the top 5 PMS funds to watch in 2025 for both impressive short-term returns and long-term growth potential:

Conclusion

Portfolio Management Services (PMS) provide investors with tailored solutions that offer personalized investment strategies, professional expertise, and flexibility. With strong returns across various categories such as Thematic, Multi-Cap, Small & Mid Cap, and more, PMS funds present a compelling choice for high-net-worth individuals seeking superior growth. While the costs associated with PMS, including management and performance fees, may be higher than traditional options like mutual funds, the potential for higher returns and customized service makes it a worthwhile consideration for those aiming to build and grow their wealth over the long term.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.